Free to use online tool to file the Form 4868 and apply for an automatic extension for your US income tax return. Full instructions are listed below.

Free to use online tool to file the Form 4868 and apply for an automatic extension for your US income tax return. Full instructions are listed below.

As we wrap up the year, the season to file your tax return for 2020 is impending. If you don’t think it’s feasible to meet the April 15th deadline due to busy scheduling, you can request for an extension to the Internal Revenue Services, by filing the IRS form 4868. The process should grant you six extra months to file your tax return. Do note that the extension is only to extend the period that you have to submit your federal tax return; it is not an extension for paying. Your balance due date is still on April 15th. If you miss paying the latter, there will be an interest payment penalty for failing to pay.

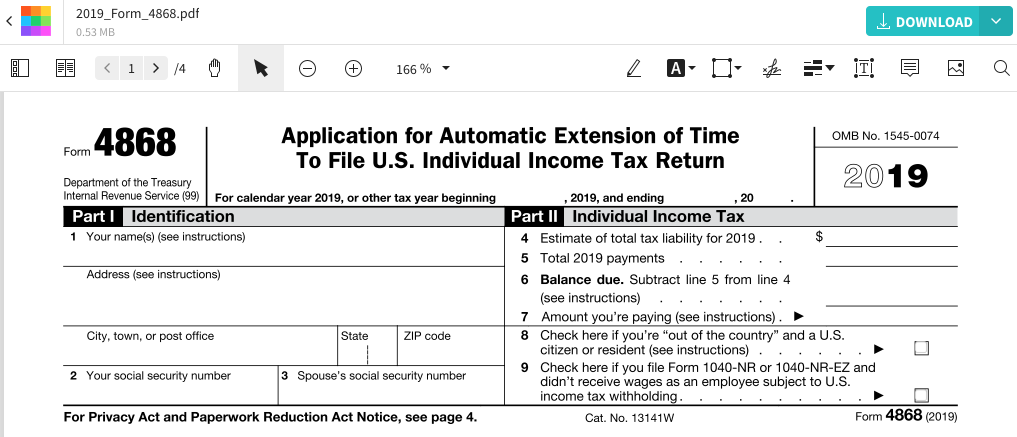

The process to file the tax extension for 2019 is relatively easy — as the form itself is less than one page. We have prepared the form 4868 — Application for Automatic Extension of Time to File US Individual Income Tax Return for you to file, print out, and submit a hardcopy to the IRS, straight from their website. This version of the form is for the current fiscal year of 2019.

How to fill out the form 4868 online

Open the Form 4868 by clicking the image or button below. Make sure that you see the correct year on the form, i.e., 2019.

On page 1, fill out your information from lines 1 through 9, wherever that is applicable.

If you are making an electronic payment simultaneously, put the confirmation number on page 3.

Note: You don’t need to sign this document.

Click ‘Download’ or ‘Print’ to save or print your completed form 4868 out.

By submitting this form, you can apply for a six-month extension for the filing of your tax returns, which should extend the extra time to October 15th, 2020, to submit various tax forms such as the 1040-NR, 1040-SR, or the 1040-SS. There is more information on how to fill the form out, as well as things to consider below.

Step-by-step instructions for each section:

Part I: Identification & Part II: Individual Income Tax

-

Name and Address — enter your legal name and current address. If you want to get the correspondent/follow up sent to your tax agent, submit their name and address, in addition to yours.

-

Social security number — this is self-explanatory.

-

Spouse’s social security number — if you are married and are filing a joint return, put your spouse’s SSN here.

-

The estimate of total tax liability for 2019.

-

The total 2019 payments.

-

The balance due (subtract the amount in line 5 from line 4).

-

The amount you want to pay.

-

Out of country — this does not mean that you are not in the US on the due date of your tax payment, i.e., on holiday. Only check this box if you are a US citizen but live and work outside the United States or Puerto Rico, or if you are doing your military/naval service. Check page two of the form for more information on this section.

-

Mark this section if you are not a resident.

Lines 4 to 6 evaluates the estimation of how much you think you have to pay. If you are submitting this form without an attached payment, you do not need to populate the fields mentioned above. If you are, the amount will go to this section.

How can I submit the form 4868?

There are three methods to file a tax extension request for the year 2019, as outlined by the IRS. You can either:

-

Pay as an estimated amount of the income tax due for the year 2019 via direct pay and indicate that this is for an extension. You can make the payment using a debit or credit card, Direct Pay, or the Electronic Federal Tax System. In this case, you do not need to submit a copy of the form 4868. To get started, go to www.irs.gov/payments

-

Using the IRS e-file system to file an extension electronically. An accountant or tax professional can also advise you to work our the due date, the taxes you owe for this tax year, amount of tax refund, and of course, filing the form 4868 online.

-

File the form 4868 above, print, and submit a hard copy along with any payments you wish to make. The address to file the paper form is available on page 4 on the document; the delivery address is different for each state. If you make payment along with Form 4868, the address will differ; the former will be sent to the Internal Revenue Service, and for the latter — you will be sending the extension to the Department of the Treasury, Internal Revenue Service Center.

Remember that you can also make a payment online via the IRS’s website, and submit a hard copy of the form 4868 via mail. On page 3 of the form, there are instructions on how to make different types of payments. If you are sending in a check, make sure that you are making the check payable to the ‘United States Treasury.’

On the other hand, if you have made a payment online, do include the confirmation number on page 3 of the form 4868. This section here is the only other part that you will have to fill out, sans page 1, and is only applicable if an online payment has been made.

Other things to consider when filing the form 4868

For the full instructions on filing tax forms, filing deadlines, and filing penalties, please check out pages 2, 3, and 4 of the Form 4868. If you have access to a tax advisor, you should go to them as well.

In case you are expecting a tax refund for the year 2020, then you will not face any ‘late-filing penalties,’ and there is a three-year period to claim your tax refund. Conversely, if you are anticipating to owe and pay taxes, then there are two types of penalties: the ‘Late Filing Penalties’ and the ‘Late Tax Payment Penalties.’ Please check the IRS’s website for more information on these charges. The eFile site also has a penalty calculator, which you can use to estimate how much you have to pay potentially.

Is the form filler free to use on this site?

Yes! The PDF Editor on our free platform can be used to fill out your form, create signatures, and annotate digital files as needed, in PDF format. If you need to supplement your extension with additional documents, convert them to PDF format and upload them to the tool for modification. And finally, in the same practice, as filing for the automatic extension of time to file your US income tax return, you can also fill out any other PDF form on Smallpdf. Have the file ready on your local drive, upload it to the PDF Editor, and work on them as you need.